How Factoring helps, a Brief depiction

Factoring is a business financing tool designed to help small business owners that have cash flow problems. It is used by B2B companies to ensure that they have the immediate cash flow necessary to meet their current and immediate needs. Many small business owners have to offer their customers payment terms i.e. the customer gets the option to pay their invoices in 30 to 60 days (which is a requirement in today’s business environment). However, many small business owners cannot afford to wait that longer for payment, they need the money sooner so that they can pay their own expenses.

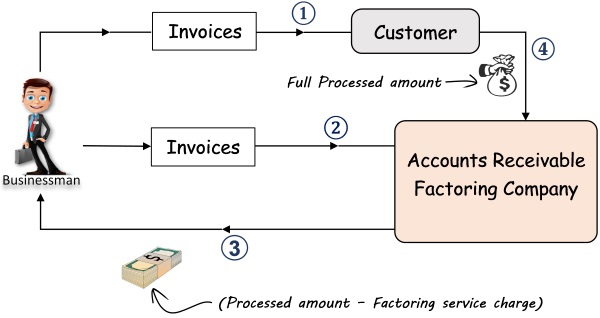

Accounts receivable factoring helps by financing these open invoices. This provides the small business owners with the money that they need to cover their business expenses. The transaction concludes once the customer pays the invoice in full, usually after 30 to 60 days.

Businessman sends the invoice to the customers (just as normally). Businessman also sends or sells the accounts receivable (i.e. invoices) to a third party i.e. the Account Receivable Factoring Company (called a factor). The A/R factoring Company processes the invoices and then they send the money in advance to the owner (i.e. the Businessman). Thus the businessman gets the money that is needed for his or her business to operate. The transaction concludes once the customer pays the invoice in full (which usually happens after some days i.e. 30 to 60 days).

The Account Receivable Factoring company may charge a certain amount of money for the factoring-service which they provide. Thus factoring is like a short-term solution as small businesses find it difficult to get loans from banks.

Comments

Post a Comment

☑ Your comment will be accepted after moderation.